Large, complex family estates require a large amount of legal, tax, and investment coordination to achieve all of their goals.

Large, complex family estates require a large amount of legal, tax, and investment coordination to achieve all of their goals.

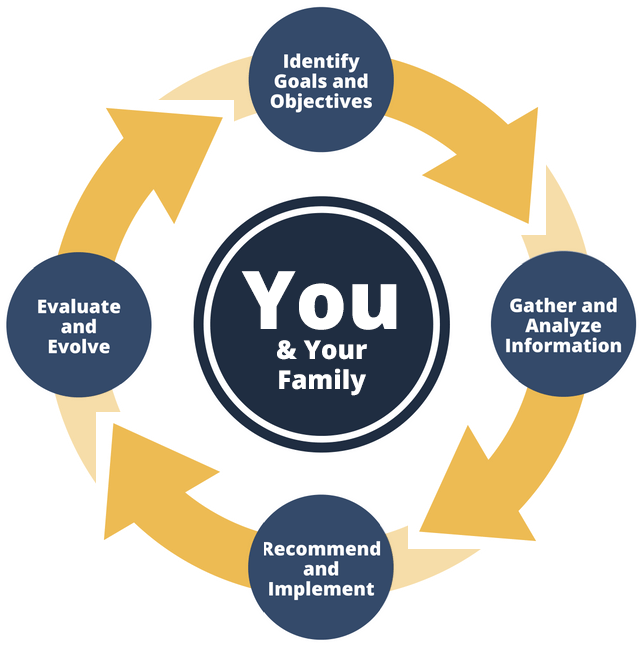

We help coordinate the different aspects of the wealth management process for family estates. Working along with your trust and estate attorney and accountant, here are some of the many things we consider:

- Intergenerational issues

- Charitable planning

- Tax minimization

- Risk management

- Liquidity needs

- Legal issues

- Estate planning

- Education funding

- Asset management

- Illiquid investments

- Property management

We help ensure your plan is working according to your wishes and up-to-date by making recommendations as needed.

And, you'll find we're able to help make even complex strategies understandable to anyone in the family.