For the majority of investors owning equities or stocks is critical to achieving their financial goals.

Many portfolio asset allocations will include some amount of equity exposure, even one designed to preserve capital. We believe in building a core portfolio where the equity exposure is gained in large part through the acquisition of high quality Exchange Traded Funds (ETFs). This allows investments to be:

- low cost

- low conflict-of-interest

- tax efficient

But we don't just stop there. We also believe that many investors can benefit from a portion of their money being invested in an opportunistic way.

This means investing in some companies through direct ownership of those stocks.

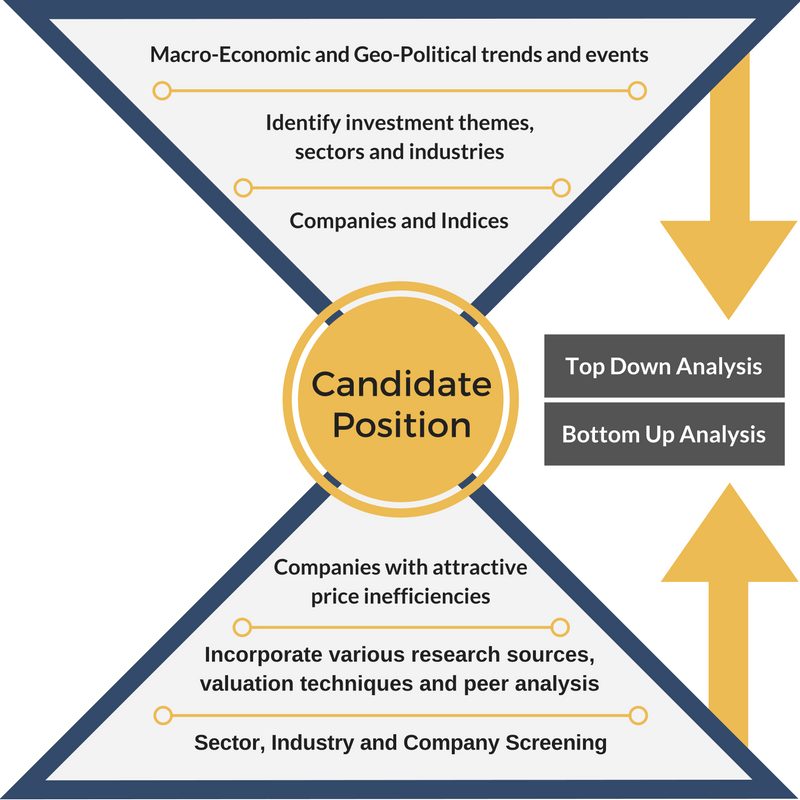

We employ both a bottom up and top down fundamental approach to identify likely candidates for investment that fit the type of opportunistic investment themes that meet each investor's needs.